A rare and lustrous metal that has mesmerized humankind for thousands of years, gold is inextricably woven into the fabric of history. Its power, beauty, and allure have fueled dreams of wealth and shaped the rise and fall of empires.

Today, gold continues to revolutionize the global economy and push the boundaries of technology and industry.

In “The History of Gold: A Journey Through Time,” we chronicle the epic story of this precious metal. We explore how gold fueled the growth of ancient civilizations, served as the foundation for monetary systems across the world, and remains a trusted store of value and investment. We trace how gold enabled groundbreaking technologies, examine its role in a sustainable future, and consider how emerging markets are reshaping demand.

This sweeping history of gold invites you on an unforgettable voyage through time. Discover the metal that has dazzled us since the beginning of human civilization—and encounter a narrative that grows more compelling by the day. The tale of gold is one of vision, passion, and perseverance, and its next chapter is still being written.

So fasten your seatbelts for a thrill ride through the ages. Gold’s dazzling past, present and future await you.

Ancient Civilizations and the Emergence of Gold as Currency

Long before coins and paper money made their way into our wallets, gold played a significant role in human history.

As civilizations emerged and grew, gold proved its worth as a medium of exchange and a symbol of wealth and power.

In this section, we’ll explore the early uses of gold in ancient Egypt, the creation of the first official currency in Lydia, and the innovations of Chinese coins and paper money.

Egyptian Gold Currency

Standardized in weight and value, gold was used by the ancient Egyptians as a form of currency.

The smallest unit, called a deben, was worth 12 shat, while the largest unit, the shat, weighed around 90 grams.

Gold was not only a precious metal but also a symbol of divinity and eternal life. Egyptians used gold to create beautiful works of art and elaborate burial items for their pharaohs, demonstrating the metal’s immense value in their society.

Lydian Coins: The First Official Currency

Minted in 600 BC by the Lydian king Croesus, gold and silver coins became the world’s first official currency.

This innovative form of money allowed for easier trade and commerce, as it provided a standardized and universally accepted method of payment.

The Greek, Persian, Macedonian, and later Roman empires adopted and refined the Lydians’ minting techniques, further spreading the use of gold coins throughout the ancient world.

Chinese Coins and the Introduction of Paper Money

China’s early coins, known as kai-yuans, were minted independently of Lydian influence.

However, it wasn’t until the 9th century AD that China introduced the first official paper currency. Paper money took off in the following decades, but rampant inflation ultimately led the Ming Empire to abandon the system.

When Marco Polo visited China in 1200 AD, he introduced paper money to Europe, setting the stage for a monetary revolution that would take nearly a thousand years to unfold.

As we journey through history, we see that gold played an increasingly important role in trade and commerce throughout the classical Mediterranean world.

From sunken treasures to the prized coins of empires, let’s delve into the fascinating story of gold’s influence on ancient societies.

Gold in Classical Antiquity: The Mediterranean World

From the sunken treasures of shipwrecks to the prized coins of powerful empires, gold played a crucial role in the classical Mediterranean world.

Its influence on ancient societies not only shaped their economies but also their cultural and political landscapes.

In this section, we’ll explore the significance of gold in Greek and Roman civilizations, its role in trade and commerce, and its value in ancient societies.

Greek and Roman Gold Coins

Drachmas, aureus, and their significance in the ancient world cannot be overstated.

Greek city-states began minting gold coins in the 6th century BC, and soon after, the Roman Empire followed suit.

These precious coins became a status symbol of wealth and power, as well as a means to facilitate trade and commerce across the Mediterranean region.

In ancient Greece, the gold stater was the standard coin, while in Rome, the gold aureus was the currency of choice.

These coins not only held intrinsic value due to their gold content but also served as a medium of exchange that connected diverse cultures and civilizations.

Gold’s Role in Trade and Commerce

Connecting civilizations across the Mediterranean, gold coins played an essential role in trade and commerce.

The vast networks of trade routes that spanned the region facilitated the exchange of goods, ideas, and innovations between the various ancient cultures.

Gold coins were used as a common currency, enabling merchants and traders to conduct business with ease.

The widespread use of gold coins also enabled governments to collect taxes and finance their military and public works projects, further expanding their empires and influence.

The Value of Gold in Ancient Societies

Measuring wealth and purchasing power in the ancient world was often tied to the amount of gold one possessed. Gold was not only a symbol of affluence but also a means to acquire land, goods, and services.

The value of gold in ancient societies can be better understood by examining the purchasing power of gold coins during that time.

For example, an ancient Greek hoplite or Roman soldier would typically receive a daily wage of one silver drachma or denarius, respectively.

However, a gold coin like the stater or aureus was worth significantly more, enabling its owner to purchase luxury items or invest in land and property.

As we continue our journey through time, we’ll see how gold’s influence extended beyond the ancient Mediterranean world and into the Middle Ages.

We’ll explore the emergence of gold coins in medieval Europe, the fluctuations in gold’s value and its impact on the economy, and the role of gold in the Byzantine and Islamic empires.

Let’s delve into the fascinating story of gold’s influence on medieval societies.

Gold in the Middle Ages: Europe and Beyond

As the world shifted and evolved, gold continued to play a significant role in various societies and economies.

During the Middle Ages, gold coins emerged in Europe, and the metal’s value fluctuated, impacting the economy.

Gold also played a vital role in the Byzantine and Islamic empires, where diverse monetary systems and innovations were developed.

The Emergence of Gold Coins in the Middle Ages

From solidus to florin, gold coins became an integral part of the medieval European economy.

As nations and empires grew, they began to mint their own gold coins, each with unique designs and values.

These coins served as a common currency for trade, commerce, and taxation, connecting diverse regions and cultures across Europe.

The solidus, introduced by the Roman emperor Constantine the Great in the 4th century AD, remained a significant gold coin until the 10th century.

In the 13th century, the florin, a gold coin minted in Florence, Italy, became widely used and highly valued.

Other notable gold coins of the Middle Ages include the Venetian ducat, the French écu, and the English noble.

Gold Fluctuations and Economic Impact

Debasements, recoinages, and inflation were common occurrences in the medieval economy as rulers attempted to manipulate their currency to their advantage.

As gold and silver supplies increased or decreased, the value of these precious metals fluctuated, impacting the economy and the value of coins.

For example, when the Spanish brought gold and silver from the New World in the 16th century, the sudden influx of precious metals resulted in inflation and the devaluation of European currencies.

Conversely, when gold and silver supplies diminished, their value increased, causing deflation and economic hardship for many people.

Gold in Byzantine and Islamic Empires

Diverse monetary systems and innovations were developed in the Byzantine and Islamic empires, where gold played a central role.

The Byzantine Empire, the eastern continuation of the Roman Empire, minted gold coins called solidus and later, the hyperpyron.

The Islamic Caliphate, which spanned a vast territory from Spain to India, developed its own gold coinage, such as the gold dinar.

These coins were highly valued and circulated widely, not only within the Islamic world but also in Europe, Africa, and Asia.

The extensive trade networks established by both the Byzantine and Islamic empires facilitated the exchange of goods, ideas, and innovations across the known world, with gold coins serving as a common currency.

As we move forward in history, we’ll explore:

- The gold rushes of the 19th century

- The development of the gold standard

- The role of gold in modern economics and investments

We’ll also take a look at:

- New applications and technological innovations in the field of gold

- Shedding light on the metal’s enduring allure and its potential future developments.

The Gold Rushes of the 19th Century

Dreams of striking it rich and transforming one’s fortune have always been a powerful motivator for humans.

In the 19th century, a series of gold rushes took place across the globe, igniting the imaginations and ambitions of countless individuals.

In this section, we’ll delve into the California Gold Rush and the Australian gold rushes, exploring their impact on the lives of the fortune-seekers and the global economy.

California Gold Rush: The Great Migration

The 49ers and the search for fortune in the California Gold Rush marked a pivotal moment in American history.

Sparked by James Marshall’s discovery of gold in the American River in 1848, thousands of hopeful prospectors flocked to California in search of wealth, forever changing the state’s landscape and economy.

While some individuals struck it rich, the majority of the 49ers found little gold and faced harsh conditions.

However, the Gold Rush did lead to a massive influx of people and the establishment of boomtowns like San Francisco, which grew from a small village to a bustling city almost overnight.

The Gold Rush also propelled California to statehood in 1850, further cementing its importance in the development of the United States.

Australian Gold Rushes

Victorian goldfields and the Eureka Stockade are just two examples of the numerous gold rushes that took place in Australia during the 19th century.

These events attracted prospectors from around the world, dramatically increasing the population and development of the Australian colonies.

Similar to the California Gold Rush, the Australian gold rushes brought both fortune and hardship to those who participated.

While some prospectors found success, many others faced difficult working conditions and disappointing returns on their efforts.

However, the gold rushes did lead to significant economic growth and the expansion of infrastructure in the region.

Impact of Gold Rushes on the Global Economy

New wealth, trade, and economic development were direct results of the gold rushes that took place in the 19th century.

The influx of gold into the global market increased the money supply, leading to inflation and the expansion of economic activities such as manufacturing, agriculture, and retail.

Additionally, the gold rushes spurred the formation of new businesses and industries.

For example, during the California Gold Rush, Henry Wells and William Fargo founded the banking institution Wells Fargo & Co., and Levi Strauss invented canvas pants that would later evolve into blue jeans.

As we’ve seen, gold has played a critical role in shaping human history and economic development.

In the next section, we’ll examine the evolution of monetary systems, particularly the gold standard, and explore the advantages and disadvantages of such systems.

The Gold Standard: The Evolution of Monetary Systems

Throughout history, monetary systems have evolved in response to the changing needs of economies and societies.

One such system that has had a significant impact on global economies is the gold standard.

In this section, we’ll delve into the establishment of the gold standard, its advantages and disadvantages, and the reasons behind its eventual abandonment.

Establishing the Gold Standard

An international framework for trade and currencies, the gold standard emerged in the 19th century as countries began to peg the value of their currencies to a specific amount of gold.

Under this system, countries agreed to exchange their currencies for gold at a fixed rate.

This provided a stable and reliable means for international trade, as countries could easily convert their currencies into gold and vice versa.

The gold standard gained widespread acceptance in the late 19th and early 20th centuries, with many countries, including the United States and Great Britain, adopting this system for their currencies.

Advantages and Disadvantages of the Gold Standard

Stability vs. inflexibility – the gold standard had both pros and cons.

One of the primary advantages of this system was its ability to create a stable and predictable environment for international trade.

By fixing exchange rates between participating countries, the gold standard reduced uncertainty and facilitated the smooth flow of goods and services across borders.

However, the gold standard also had its drawbacks.

One of the primary criticisms was its inflexibility. Since the money supply was determined by the amount of gold in circulation, governments and central banks had limited tools to address economic fluctuations and imbalances.

This inflexibility could lead to deflation and economic stagnation, as countries struggled to adjust their money supply in response to changing economic conditions.

Abandonment of the Gold Standard

From World War I to the Great Depression, the gold standard faced numerous challenges, ultimately leading to its demise.

The outbreak of World War I saw many countries suspend the gold standard to finance their war efforts. This suspension weakened the system and led to a period of instability and inflation.

The Great Depression further exposed the flaws of the gold standard.

As countries around the world grappled with economic collapse, they turned to protectionist measures and currency devaluations, ultimately abandoning the gold standard in favor of more flexible monetary systems.

As we’ve seen, the gold standard played a significant role in shaping international trade and monetary systems throughout history.

However, its inherent inflexibility and the changing nature of global economies led to its eventual abandonment.

In the next section, we’ll explore the role of gold in modern economics and investment, including its use as a hedge against inflation, its role in diversifying investment portfolios, and the factors influencing gold prices.

The Role of Gold in Modern Economics and Investment

Today, gold’s allure continues to captivate investors and individuals alike.

Its enduring value and unique properties make gold an attractive option for those looking to diversify their investment portfolios and protect their wealth against economic uncertainties.

In this section, we’ll explore gold’s role as a hedge against inflation, the various ways to invest in gold, and the factors that influence gold prices in the modern world.

Gold as a Hedge Against Inflation

Preserving wealth in uncertain times is a top priority for many investors, and gold has long been considered a reliable hedge against inflation.

As paper currencies lose value due to inflation, gold tends to maintain its purchasing power, providing a safe haven for investors looking to protect their wealth.

Throughout history, gold has shown a remarkable ability to retain its value, even during periods of economic turmoil and high inflation.

Investing in Gold: Bullion, ETFs, and Mining Stocks

Diversifying portfolios with precious metals like gold can provide added stability and protection against economic fluctuations.

There are several ways to invest in gold, including:

1. Gold bullion:

Physical gold, such as coins and bars, can be purchased and stored as an investment. This option allows investors to have direct ownership of the precious metal.

2. Exchange-traded funds (ETFs): These investment vehicles hold physical gold and trade on stock exchanges, allowing investors to gain exposure to gold without actually owning the metal.

However, it’s essential to consider the net asset value (NAV) when investing in ETFs, as the purchase price may exceed the NAV.

3. Mining stocks: Investing in gold-mining companies can provide leverage to gold’s price performance.

However, investors should be aware of the political risk factors and challenges in maintaining gold production levels when investing in mining stocks.

Each of these investment options has its advantages and potential drawbacks, so it’s crucial to carefully consider your financial goals and risk tolerance before investing in gold.

Factors Influencing Gold Prices

Currency values, market expectations, and human psychology all play a role in determining gold prices in the modern world.

Some of the key factors influencing gold prices include:

1. The value of the U.S. dollar:

A strong dollar tends to drive down gold prices, as it makes gold more expensive for investors using other currencies. Conversely, a weak dollar can lead to higher gold prices.

2. The decline in the value of fiat currencies: As paper currencies lose value due to inflation, investors often turn to gold as a store of value, driving up its price.

3. Market expectations surrounding inflation: If investors believe that inflation is on the rise, they may turn to gold as a hedge, increasing demand and driving up prices.

4. Political and economic uncertainty: During times of geopolitical tension or economic instability, investors often flock to gold as a safe haven, leading to increased demand and higher prices.

Understanding these factors can help investors make more informed decisions when it comes to investing in gold.

As we look to the future, it’s clear that gold will continue to play an essential role in the global economy and the investment landscape.

In the next section, we’ll explore new applications and technological innovations involving gold, shedding light on the metal’s enduring allure and its potential future developments.

The Future of Gold: New Applications and Technological Innovations

Beyond bullion , gold has a variety of uses that extend far beyond its role as a store of value and investment vehicle.

In this section, we’ll explore some of the innovative ways in which gold is being used in technology and industry, the growing importance of gold recycling and sustainability, and the impact of emerging markets on future gold demand.

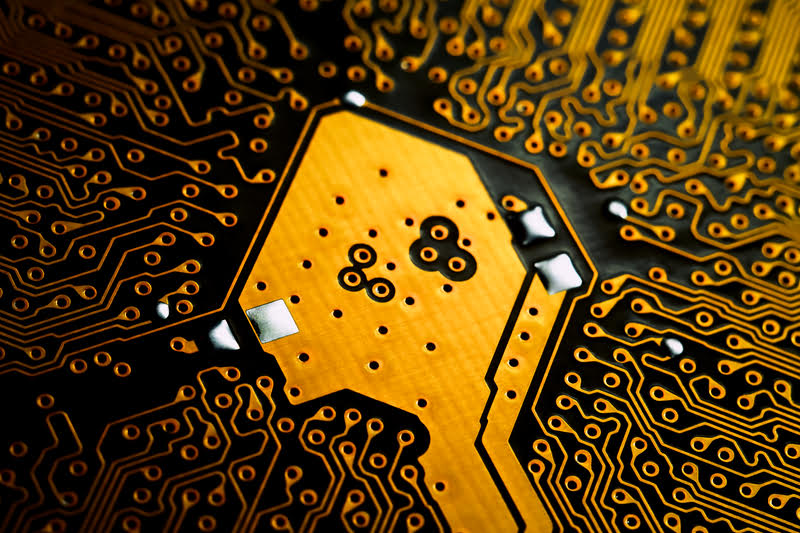

Gold in Technology and Industry

Electronics, medical devices, and green energy are just a few sectors where gold is finding new applications and uses.

Due to its excellent conductivity, resistance to corrosion, and malleability, gold is a highly sought-after material in the electronics industry.

It’s used in components such as connectors, switches, and even in the production of integrated circuits and printed circuit boards.

In the medical field, gold is used in a variety of applications, including dental fillings, cancer treatments, and medical implants.

Its biocompatibility and resistance to corrosion make it an ideal material for these purposes.

The green energy sector is also benefiting from gold’s unique properties.

For example, gold nanoparticles are being used in photovoltaic cells to improve their efficiency and reduce the cost of solar energy production.

As technology continues to advance, we can expect to see even more innovative applications for gold in various industries.

Gold Recycling and Sustainability

Reducing environmental impact and conserving resources are becoming increasingly important as the world’s population grows and natural resources become more scarce.

Gold recycling plays a crucial role in addressing these challenges by reducing the need for new mining operations and minimizing the environmental impact of gold production.

Gold is highly recyclable, and a significant amount of the world’s gold supply comes from recycled materials.

This includes gold from electronic waste, jewelry, and even coins.

By recycling gold, we can help to conserve natural resources, reduce the environmental impact of mining, and promote a more sustainable future for the gold industry.

Emerging Markets and the Future of Gold Demand

Growing middle classes and investment opportunities in emerging markets are expected to play a significant role in shaping the future of gold demand.

As countries such as China, India, and Brazil continue to develop their economies, the demand for gold is likely to increase.

This includes not only investment demand but also demand for gold in various industries and applications.

In addition, central banks in emerging markets have been increasing their gold holdings in recent years, further supporting the demand for the precious metal.

As the global economy continues to evolve, the future of gold demand will be influenced by a combination of factors, including technological innovations, sustainability initiatives, and the growth of emerging markets.

Final Thoughts

Throughout the ages, gold has truly stood the test of time, serving as a constant beacon of value and prestige.

From its origins deep in ancient civilizations to its compelling role in modern economics and investments, gold has proven its mettle.

As a versatile and captivating asset, gold offers unique properties that attract investors seeking to diversify their portfolios.

For those intrigued by the gleaming allure of gold, multiple investment avenues beckon, such as gold bullion, ETFs, and mining stocks.

Furthermore, gold’s potential extends beyond the realm of finance, finding innovative applications in cutting-edge industries like electronics, medical devices, and renewable energy.

As emerging markets like China, India, and Brazil take center stage, the global appetite for gold is set to grow, driving demand and influencing its value.

For anyone considering delving into the world of gold investments or simply seeking a deeper understanding of its historical significance, a wealth of fascinating insights and opportunities await.

So, don’t hesitate – embark on your golden journey today and uncover the shimmering secrets of this timeless treasure.